AutoFinance

Transform Your Accounting & Compliance using Intelligence from Your Financial Data

AutoFinance

Transform Your Accounting & Compliance using Intelligence from Your Financial Data

Improve Cutomer Experience and Grow Your Business

Streamline Annual Compliances and ITR (Tax) Filings for Individuals and Small Businesses with Secure, Instant access to Customer Data with NUVO Artificial Intelligence

90% Faster Processing

Eliminate manual data collection and entry, Instant access to Bank Statements, Investments and Financial Records.

Bank-Grade Security

End-to-end Data Security via SSL-256 Encryption and User Consent Mechanism enures Financial Data is shared to correct entities.

Automated Compliance

Generate ITR, MCA Forms, GST returns, and Compliance reports automatically from real-time Financial Analytics using AI-ML.

Enhanced Client Experience

Provide Seamless Service and Build Trust with Individuals and Business Owners with Financial Process Automation Workflows

Scale Your Practice

Handle 3x more clients with the same team. Focus on advisory services instead of data collection.

Real-time Data Insights

Access live financial data for better tax planning and compliance advisory throughout the year.

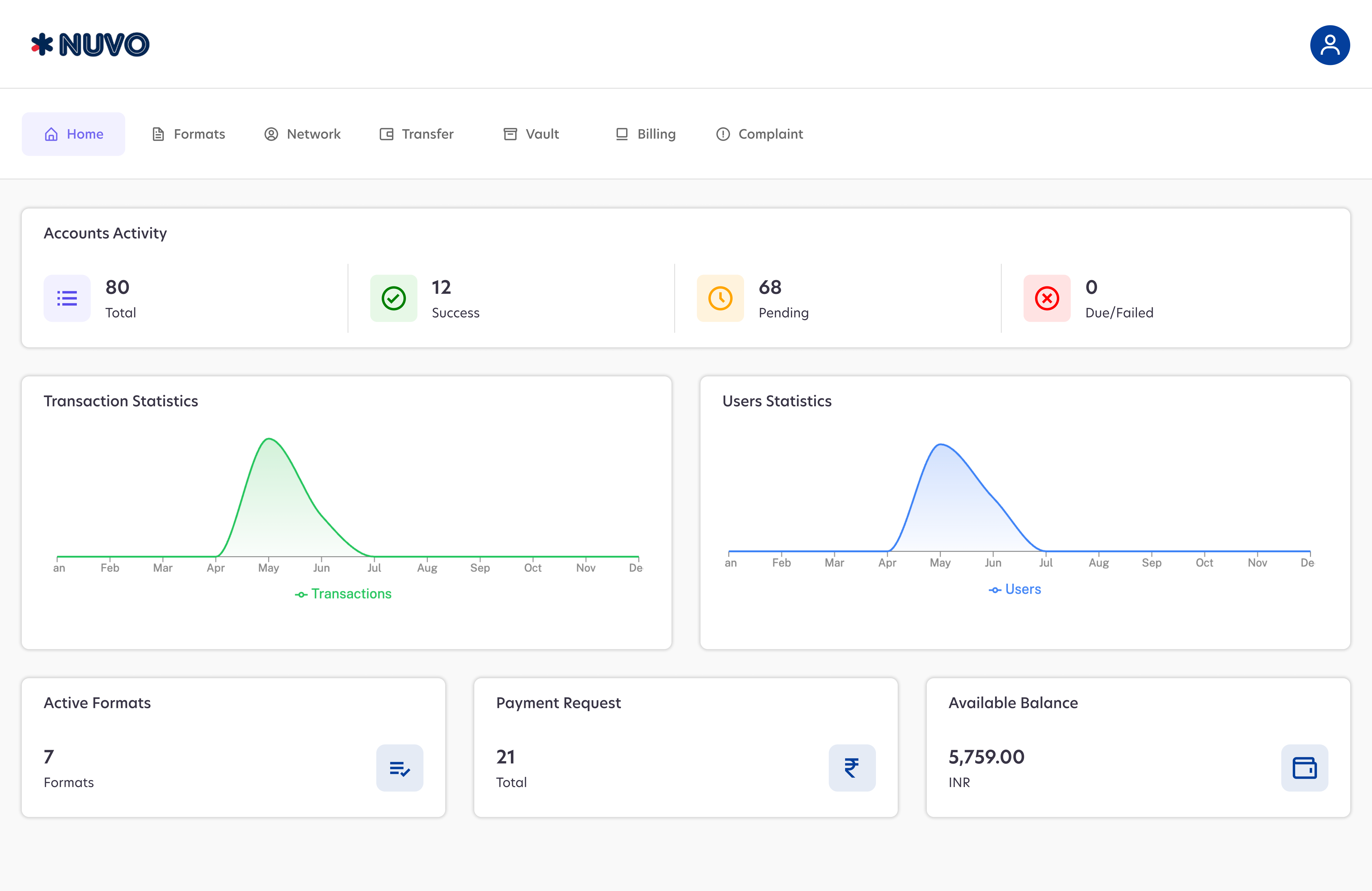

Simplify Your Customer Data Management

Automate Data Collection and Document Quality Checks usign AI-ML, so Your Team can Focus on Customers

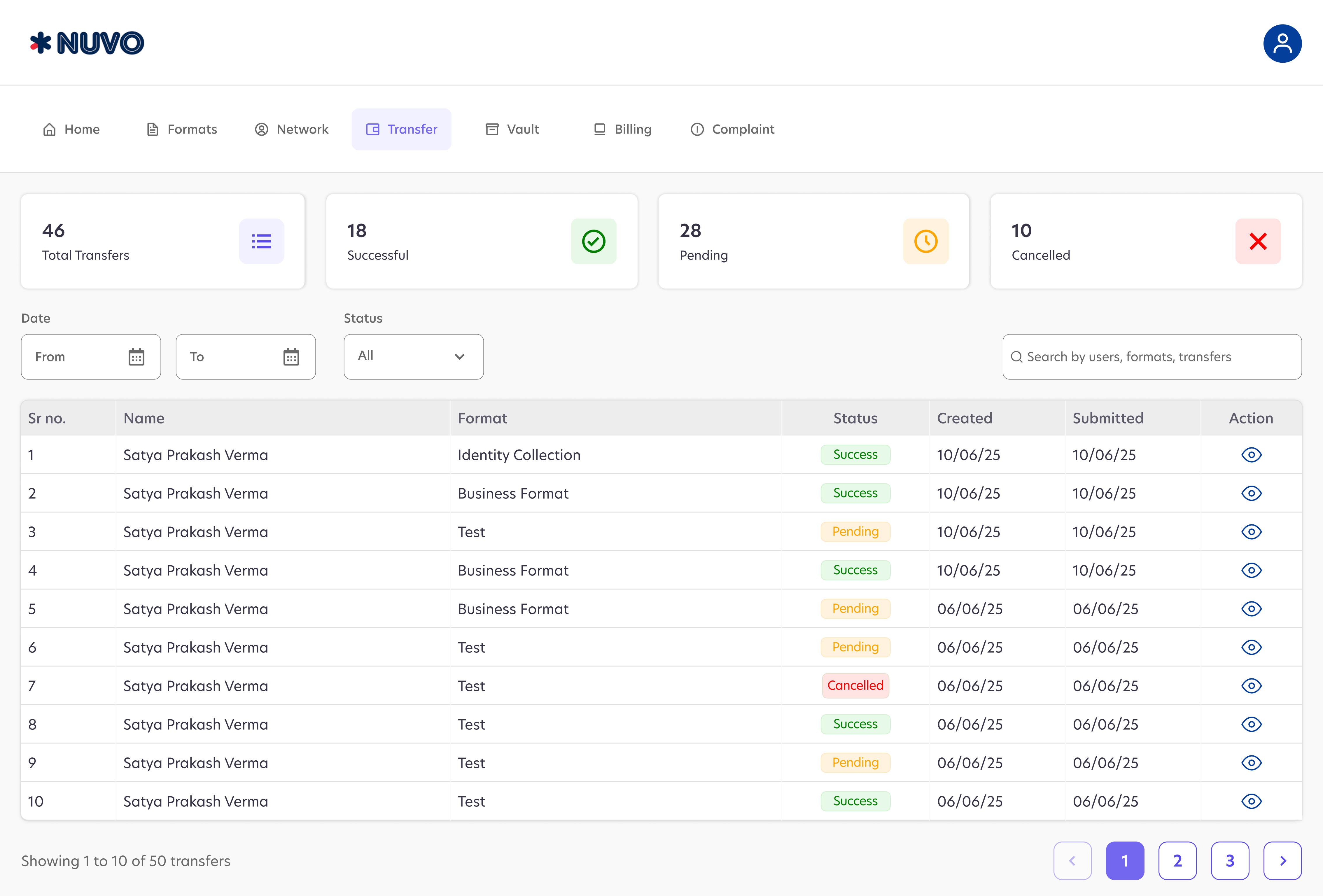

How It Works in 3 Simple Steps

Experience the future of Accounting Profesional Practice with streamlined data access and automated compliance processing.

Client Consent

Client provides one-time (or regular) consent through secure Consent Manager interface to share requrested financial data.

Instant Data Access

Get real-time access to bank statements, mutual funds, insurance, other financial data with consumer consent.

Automated Procesing

Generate ITR, MVA Forms, P&L, GST returns, and compliance reports automatically with accurate, up-to-date data.

Frequently Asked Questions

Got questions? We've got answers. Find what you need here.

Who should file an ITR?

An individual whose annual income is more than the basic exemption limit of Rs 2.5 lakh should file an ITR. The basic exemption limit for senior citizens (60 years onwards and less than 80 years) is Rs 3 lakh, and for super senior citizens is Rs 5 lakh.

Is my data shared via AutoFinance secure?

AutoFinance uses a 128 bit SSL encryption for transmission of data and enables complete data privacy. Also, AutoFinance does not share its data with unaffiliated third parties

Automated Compliance

Generate ITR, GST returns, and compliance reports automatically from real-time financial data.

Enhanced Client Experience

Provide seamless service to individuals and SMBs with minimal documentation requirements.

Scale Your Practice

Handle 3x more clients with the same team. Focus on advisory services instead of data collection.

Real-time Data Insights

Access live financial data for better tax planning and compliance advisory throughout the year.

Resources

AutoFinance Website

Visit Site